Loan Information

Trigger Leads – What Are They & What You Can Do

Do Credit Bureaus Sell Your Information – Trigger Leads Have you ever had your credit report pulled when applying for a loan, only to be swarmed with calls from creditors trying to sell services or offer loans? This isn’t a coincidence, and is one of the most annoying aspects of applying for credit for today’s…

Read MoreShould You Pay Points?

Should You Pay Points? When getting a mortgage, one of the most important things to pay attention to is the cost of the loan being applied for. There are certain fees customers can shop for that may be drastically different from one lender to another (for example, discount points, and lender fees) and some fees that…

Read More2022 Conventional Loan Limits

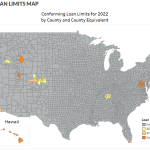

Each year toward the end of November, FHFA (Federal Housing Finance Authority, the agency overseeing Fannie Mae & Freddie Mac) releases updated loan limits for the following year. This sets the maximum amount of money that can be borrowed under conventional lending guidelines. Today’s announcement informed us that for 2022, conventional loan limits will be…

Read More8 Things to Consider When Refinancing

8 Things to Consider When Refinancing Since the 1980s, rates in the US have consistently fallen on mortgage loans, with new all time lows regularly being established. Refinancing can be a great financial decision, but it’s important to consider a few things before diving in so you can be prepared for the process, outcomes, and…

Read MoreMortgage Myth: Skipping a Payment

Mortgage Myth: “Skipping a Payment” when Refinancing One of the most common myths in the mortgage world is an oft-misunderstood aspect of refinancing when it comes to the first payment date of a newly originated/refinanced loan. Many times consumers and loan officers alike are confused by the timeline of having one loan paid off and payments…

Read MoreThe Best Mortgage Term for You

Is the 30 year fixed rate mortgage the best loan? Yes! Is the 15 year fixed rate mortgage the best loan? Yes! Is the 10 year mortgage the greatest of loans? Yes! How can all 3 of these loan terms be the best? Well, they’re all the best option for different people. At MasonMac,…

Read MoreHow To Get the Best Mortgage Rates

Mortgage rates have gotten a lot of airtime in the media recently. Currently near all-time lows, many people are shopping for a new mortgage right now, and rightly so! With the opportunity to reduce monthly payments, access equity to pay other bills or complete renovations, or reduce a loan term, it’s a great time to…

Read MoreThe Shift to a 45 Day Home Buying Process

Buying a home? Want some advice that’ll save you a ton of stress and make the home buying process more enjoyable? Make your contract date longer than 45 days. Your agent doesn’t think that’s possible? Send them this blog : ) The mortgage industry is currently in the middle of a business boom due…

Read MoreVA Mortgage Loans Getting More Restrictive

Predatory lending. Churning. Taking advantage of borrowers. These are words and phrases that should be only distant memories of the pre-housing crash mortgage market of the early 2000s. Unfortunately though, they’ve all been brought up in today’s marketplace as well, specifically when it comes to VA mortgage loans and recent actions taken by Ginnie Mae…

Read MoreMortgages for Millennials

Is there a mortgage program for millennials? With all of the headlines, media quotes, and information out there, you would think mortgages for millennials would incorporate a slew of products, programs, educational courses, and more. The reality, though, is far less fancy. While there are a ton of mortgages for millennials, the programs available…

Read More